Blog

Twitter Collections Files and Folders System

This post is a guide for you to both to use Collections as a file and folder system.

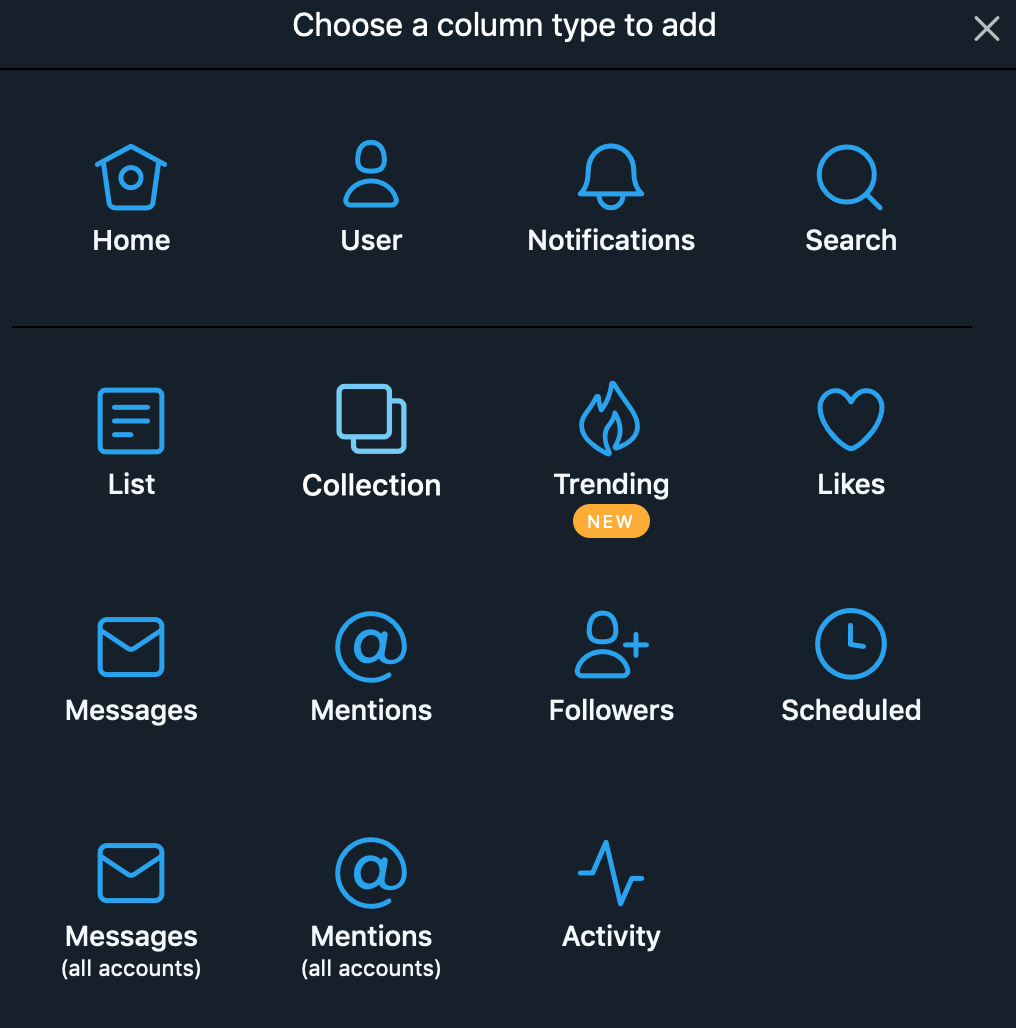

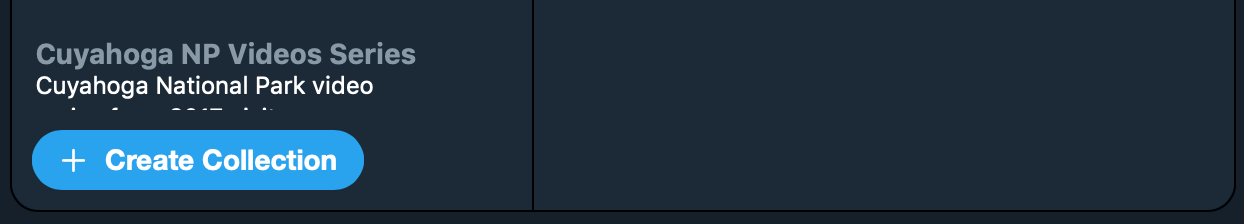

I like to begin by opening Tweetdeck and creating the new Collection I am going to populate content into first. Click "Add Column" to launch the following prompts.

After tweeting, you can then place the tweet/content into the collection.

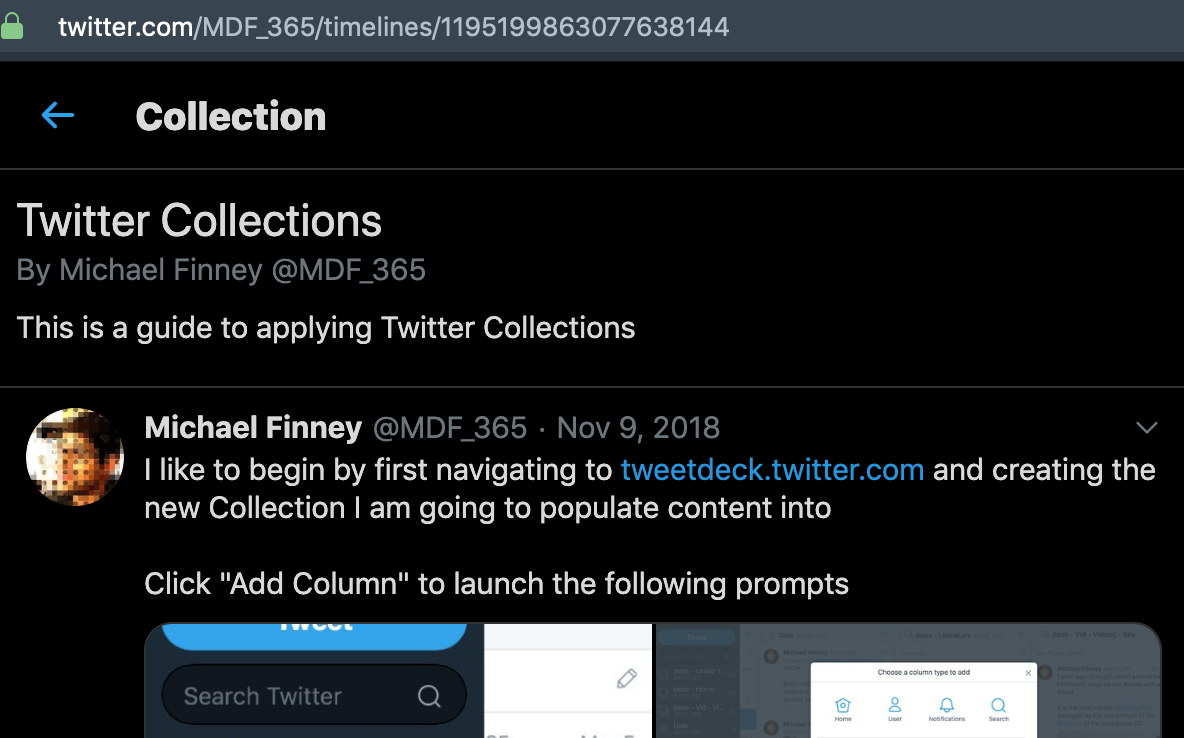

Next, “View” the Collection on Twitter itself.

You will be taken to a timeline-esque location that displays the Collection - by tweeting the URL of this collection, it can then be added to other collection as well.

Additionally, groups of Tweets can be gathered into Moments, which can be embedded similarly to a standard tweet. The reason I have created this entry is to illustrate how Twitter can operate as a content nexus for distribution across other platforms on the Web. By utilizing these functions to increase the visibility of tweets, their gravitational pull can grow.

Hopefully this has been a worthwhile look at applying these ideas for yourself. While embedding tweets is not a new feature, the notion that a tweet can become an interchangeable evergreen piece of content or that an entire blog entry could be constructed exclusively of tweets or Moments is something I haven’t yet seen widely applied.

Cryptocurrency: Law of the Land in a Layperson's Language

Things are changing rapidly in the new arena that Bitcoin has initiated. We are living on the legal edge, as people's understanding of this technology and the government's perspective for financial regulation of it is getting defined live in front of us.

Things are changing rapidly in the new arena that Bitcoin has initiated. We are living on the legal edge, as people's understanding of this technology and the government's perspective for financial regulation of it is getting defined live in front of us.

While the topic is complex, the legal framework for monitoring it is rooted in the existing structures that have been working to keep economic technologies on the rails for decades. Now, I'm not a heavy trader nor any sort of Wall St. insider so my information depth is evolving in realtime right along with the decisions being handed down. However, I think it is critical that the average person like myself and possibly like yourself have a better grasp of what is occurring so that our discussions with each other as well as friends and family utilize terminology that put us at the same table.

Personally, I think it's important that we keep one eye on innovation and one eye on the folks working to monitor the risks inherently surrounding any new industry or venture. What's that saying about "an ounce of preparation being worth a pound of cure?"

Luckily there are folks willing to put in the effort to advance the discourse with regulative bodies such as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) because as Bryce Weiner (developer of Tao Network [XTO]/Altmarket and many other music industry-related ventures) phrased it "information symmetry" is critical for and a reflection of a healthy market. This article is primarily a mirroring of a few conversations I've had with him recently on the phone and via Twitter regarding these issues. Because fundamentally it isn't a good idea to just stick your fingers in your ears and start singing "la la la la" to drown out the conversations you don't want to hear.

Luckily there are folks willing to put in the effort to advance the discourse with regulative bodies such as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) because as Bryce Weiner (developer of Tao Network [XTO]/Altmarket and many other music industry-related ventures) phrased it "information symmetry" is critical for and a reflection of a healthy market. This article is primarily a mirroring of a few conversations I've had with him recently on the phone and via Twitter regarding these issues. Because fundamentally it isn't a good idea to just stick your fingers in your ears and start singing "la la la la" to drown out the conversations you don't want to hear.

Words and Definitions

I'm not going to reinvent the wheel and putting my personal understanding aside, for this discussion "crypto" should be understood to be short for "cryptocurrency" and will not be a truncated version of one of it's parent technologies: "cryptography". Perhaps you recall a few months back when the SEC declared that both Bitcoin and Ethereum were not classified as "initial coin offerings" (ICOs)?

I'm not versed enough in the legal intricacies of that designation to insert myself into the derivative debates about how that decision came to be and whether it is right (I've only been paying attention to the entire crypto space attentively for a little over a year). However, it does carry some weight in regards to many of the other token offerings that tout blockchain as a revolution to business operations and seek to raise huge sums of money to launch their efforts to market.

It is likely this approach to raising venture capital that has lead to the hammer being brought down on a number of them. While the SEC declaration spells out how to properly offer a token and blockchain-based security, it isn't the end regulatory oversight. As mentioned earlier, the CFTC gets a say as well in regards to commodities not seeking vast monetary infusion prior to those offerings. I believe there is a fundraising cap of $100k that keeps commodities from being declared as securities and allows entrepreneurs to avoid additional rounds of litigious heavy-lifting and filing of documentation for review by the SEC.

Is this all making sense for you? It's a lot to process, I know - here's a few more layers of complexity. As Mr. Weiner clarified "there are commodities and securities and blockchains can exhibit traits of either based on how it is executed." And we haven't even really addressed what money is yet. Well, as it turns out, he added a "blockchain commodity...can be money". As readers of David Graeber's book "Debt: The First 5,000 Years" are aware, money has taken many forms across history such as commodities and more recently fiat. I hope this isn't confusing for you because it was at this point in the conversation that these points clicked and inspired me to type all this out.

Currently we are seeing that there is fluidity about how to define crypto technology but perhaps we need to sort out any fluidity in the language surrounding blockchain, tokenization, and what rightly deserves to be called a cryptocurrency. Hopefully this article helps you to understand what is occurring - writing it has certainly clarified portions of my view (which is always adapting) about the topic.

The Bitcoin Network Effect

The Internet is a codependent system of networks which expose selections of information to each other for a variety of reasons (most often for commercial purposes). Each subnetwork ecosystem, while revealing information to other networks, still retains a degree of autonomy.

Though each networks has independent value it may potentially be evaluated potentially greater while interconnected because of the expressable value of the data or functionality to others. However, even adjacent networks that are solving similar problems coexist in the market for a time, though we are seeing both telecommunication and cable-providers butting up against existential threats to their long term existence.

Technological advances can look like a brand new product with a unique purpose or a suite of them that solves a collection of roadblocks together but also applies to existing hardware serving unpredicted solutions to problems it was not initially designed to fix.

Comparing the Development of Bitcoin to the Internet

Bitcoin is a new field which can be extremely difficult to jump into without at least some template to follow. Because the Bitcoin protocol operates as a collection of tools atop the existing Internet infrastructure, such as the Web overlays the Internet, comparing it to the telecom industry is the likely most fitting. Developments like TCP/IP were useful to other applications such as communication standards which allowed the Web to proliferate.

Further along the sequence of adoption, mobile devices or other solutions such as sensors are needed to bridge between the digital information layers and the physical world where we live and work.

Bitcoin seems more like a first-level protocol solution (like TCP/IP) - a platform or vehicle to standardize monetary language across the Internet. A second layer of application-specific solutions is only now beginning to be realized akin to those available for traditional currency issues such as POS (Lightning Network - which in ways at first glance resembles the User Datagram Protocol [UDP]) or long term secure storage (Casa HODL).

Presently many altcoins are examples of potential value in a startup sense. They can serve as experimental projects to solve problems that the Bitcoin protocol might select to incorporate in the future or else operate as smaller ecosystems (networks) with paid access via Bitcoin. There may not be a need for them to operate as currencies inherently though (there is similar potential for manipulation as can manifest in traditional finance).

Constructing the Bitcoin Onramp

Localized economies that are currently utilizing or expressed in Bitcoin don’t require every downstream solution, nor does the entire Bitcoin economy require the capability to interface in the ways those subnetworks may (for example, consider a business network with proprietary software that is walled-off from users beyond the organization). Point being, boom and bust cycles are probably natural reflections of human nature. Insulating against them seems like rigging the game against small entities in favor of chosen operators.

Global adoption estimates float between 5-10% for the entire crypto-asset market. This is incredibly small, but the community of users is passionate. Like any technology that is revolutionary, Bitcoin and other tokens have a mythological aura at present. Imagine early conversations about electric light, airplanes or even recall how people spoke about the Web in the 1990’s, widespread understanding of the science is low but the backbone infrastructure necessary to produce them is essentially magic (even to this day).

It would be easy to dismiss Bitcoin as a risky asset with an unknown future but as this first cryptoasset approaches 10 years of activity, it becomes more challenging to wave away. Additionally, it would be easy to say, that with such low adoption numbers that no one is using it.

How many people were using electricity without power lines or sockets for bulbs? How many commercial flights were in the air before airports dotted the landscape?

Right now developers are actively solving problems for businesses and organizations to interface with Bitcoin as well as by creating altcoins that serve very particularly community needs. Some of this will work, much of it won’t, but the result will be a more robust set of tools that are available for everyone along the way.

Wrapping Up the Analogy

When comparing to the advancements in telephony that ultimately lead to the Internet, Bitcoin is still in the era when the Bell system was competing with telegraph services (traditional fiat currencies in our analogy). Drawing out the analogy further, the Web didn’t emerge until the Berners-Lee codified the standards of HTML. It took 10 years before it was ubiquitous in the US market and approximately another 10 before most people were walking around with the Web in their hands thanks to smartphones on the mobile cellular system. If Bitcoin is DARPA timeframe Internet, the emergence of the Lightning Network seems comparable to a BBS in the time when dial-up modems ruled.

While it is easy to look back retrospectively at technologies that have come to dominate or alter industries, speculating about the future of money formats seems tenuous. However, I would say that Bitcoin isn’t so much the emergence of a new currency platform so much as the application of new technology to sound money principles and the rejection of a technology known as fiat currency. That’s another discussion topic altogether though.

In the meantime, its going to be interesting to watch the Bitcoin protocol scale out into deeper alcoves of our global economy over the next decade in much the same way that the Web has democratized media, marketing and Internet-based entrepreneurship. As my comparison of Bitcoin to the Web as a second layer that emerged from the hardware infrastructure unified as the Internet comes to end, I think it’s important to mentioned that the Web may have been a first iteration of that stacked content before building out the transactional capability. Bitcoin unifies these ideas in the token, information and value are one. It may be better to compare its potential instead not to Tim Berners-Lee and the Web but instead a richer platform hypothesized by Ted Nelson that he called Xanadu.

Next Leg of the Curve: The Future of Processing

The elder generations always warn us how fast time seems to move when you get old. As kids we don’t listen, we’re infinite and invincible. The bill always comes due though.

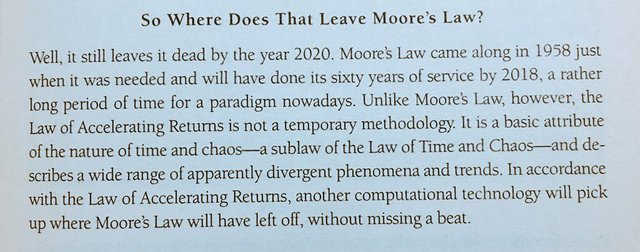

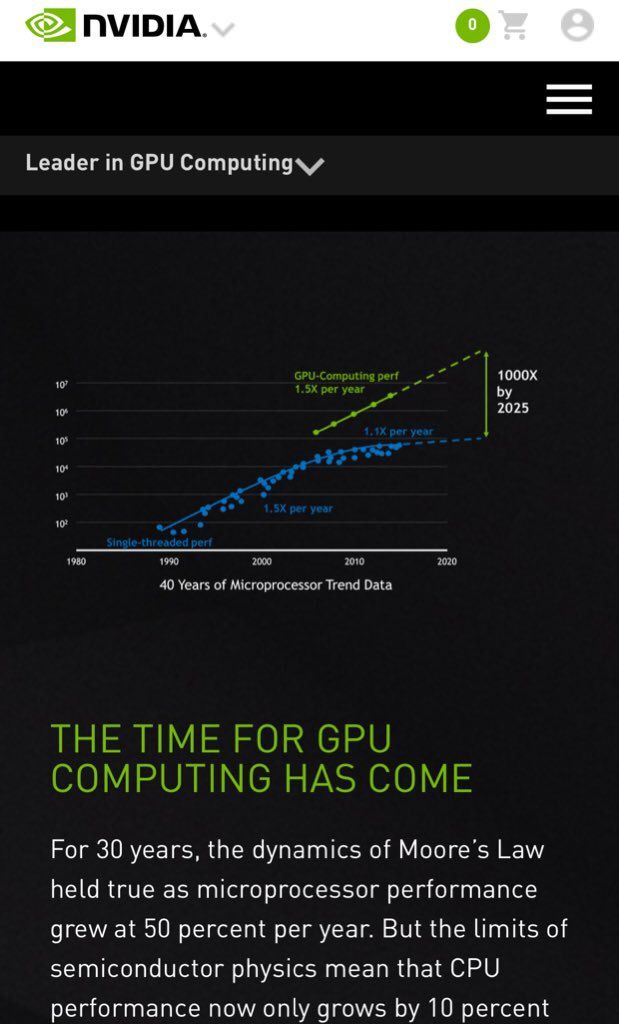

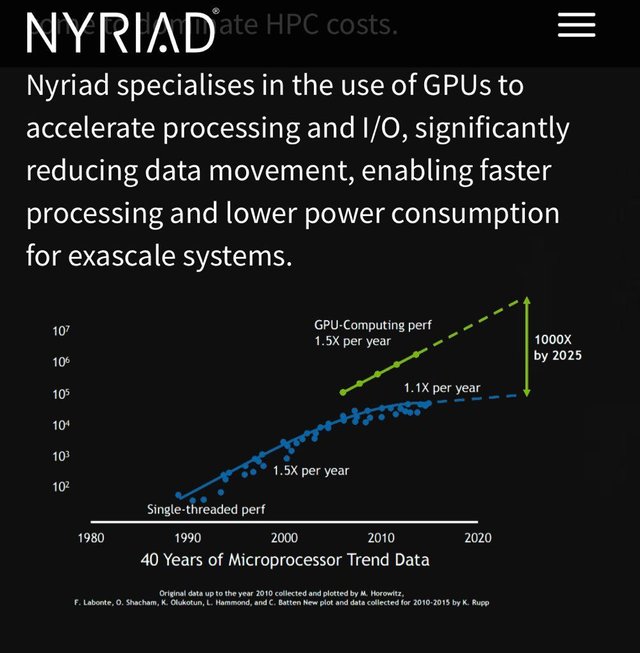

The accelerating rate of returns (Moore’s Law), compound interest in banking or the doubling rate of processor capability in computation has allowed those industries to bloom through the second half of the 1900’s. Nearly a fifth of the way through the 21st century, we are watching central processing units plateau in regards to speed due to engineering limitations.

Kurzweil published “The Age of Spiritual Machines” in January of 1999 - that’s nearly 20 years since it was written and the clock has finished counting down. The predictions regarding Moore’s law and processors was very accurate. The science of CPU development has reliable calculations, as it turns out!

We even know what “new” processing technologies are seeking to accelerate the pace again for a bit. If you could soundly ride waves toward bankable future outcomes, which would you consider right now?

Below are a few directives seeking to pick up the torch for the CPU in no particular ranked order. Please feel free to drop additional links into the comments of this article as well.

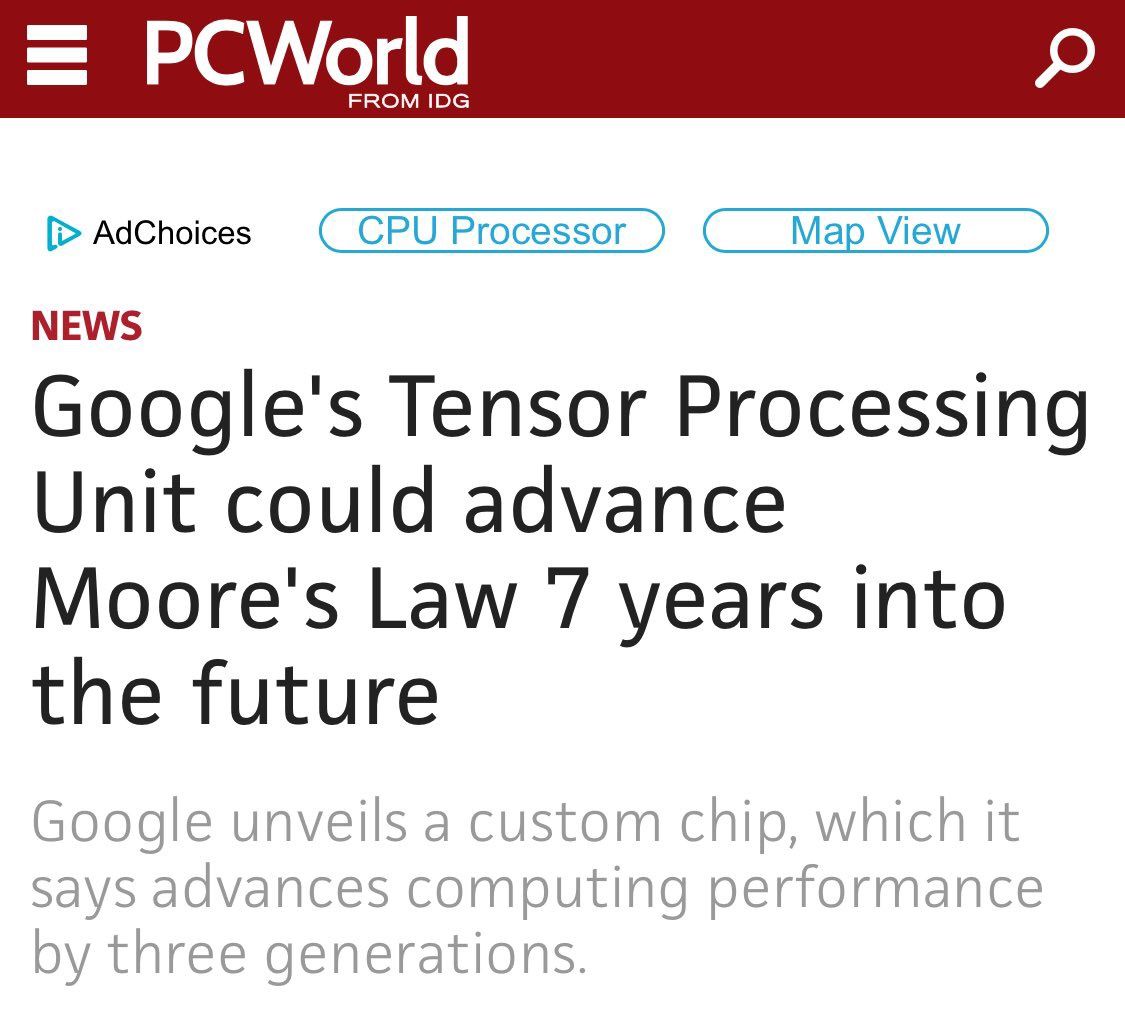

Google is promoting the tensor processing unit (TPU) as a service-accessible product for machine learning, only available as a lease. These processors are considered to be application-specific integrated circuits (ASIC). It’s fairly impressive how little is known about the architecture of the TPU given that Google has been promoting them since 2016 though.

For additional insights on the design of TPUs, this article is a fairly detailed breakdown of their current state and progress based on promotional images.

Microsoft & IBM

A few different companies like Microsoft & IBM are working on field programmable gate array (FGPA) software/hardware releases. However, these are considered to be similar ASICs that are popularly used by cryptoasset miners. The engineering and production costs are actively being debated and assessed in the community in regards to benefits and trade-offs.

Nvidia

Companies like Nvidia & Nyriad are focused on graphical processing units’ (GPU) ability to be a viable solution for the limits imposed by Moore’s law.

As the dominant player in the GPU industry, Nvidia has strong incentives to show that their technology can be versatile in its versatility and increase their value to users and stockholders alike.

Just watching the trends...

Sometimes you have to trust your guts...